CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Regulation

CMC Markets, established in 1989, and HYCM (Henyep Capital Markets), founded in 1977, are two prominent online brokers in the finance industry. CMC Markets stands out with its publicly traded status on a stock exchange and boasts a perfect Trust Score of 99 out of 99 according to ForexBrokers.com, marking it as highly trusted. It holds six Tier-1 licenses, reflecting strong regulatory recognition. Despite not being a bank, CMC Markets remains a secure choice for traders looking for trust and transparency.

On the other hand, HYCM is a privately held firm that holds two Tier-1 licenses and one Tier-2 license, giving it a respectable Trust Score of 86. While not at the level of CMC Markets, it is still considered trusted. Both brokers are not banks but have built a long-standing reputation in the industry. Whether it's CMC Markets' higher regulatory credentials or HYCM's enduring market presence since 1977, both offer unique strengths to their clients.

|

Feature |

CMC Markets CMC Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Year Founded

info

|

1989

|

1977

|

|

Publicly Traded (Listed)

info

|

Yes

|

No

|

|

Bank

info

|

No

|

No

|

|

Tier-1 Licenses

info

|

6

|

2

|

|

Tier-2 Licenses

info

|

1

|

1

|

|

Tier-3 Licenses

info

|

0

|

0

|

|

Tier-4 Licenses

info

|

0

|

1

|

Fees

CMC Markets vs. HYCM on commissions and fees: CMC Markets earns 5 stars and ranks #4 out of 63 brokers in the Commissions and Fees category, and it won the #1 spot in our 2025 Annual Awards for this category. HYCM earns 4.5 stars and ranks #18 out of 63. Both are competitively priced, but CMC often comes out cheaper for frequent forex traders.

CMC Markets keeps pricing tight across account types. Typical EUR/USD spreads average 0.61 pips (Aug 2023). Its FX Active plan charges $2.50 per side with minimum spreads from 0, bringing the all-in cost to about 0.5 pip on EUR/USD (and five other majors). For example, NZD/USD is 1.5 pips on the standard account but drops to about 0.5 pips with FX Active. High-volume traders can lower costs further with the Price Plus Scheme: you earn two Trading Points per standard lot, and Tier 4 (about 1,250 lots in a month) unlocks a 20% spread discount. FX Active is available in selected regions on MT4 and the Next Generation platform.

HYCM is strong value with its Raw account, which delivers about 0.6 pips all-in on EUR/USD after commission. Its Classic account is pricier with variable spreads from 1.2 pips, and the fixed-spread account lists 1.5 pips. In simple terms, HYCM’s best pricing comes close to CMC’s FX Active, but CMC typically edges it on the tightest pairs and adds volume-based discounts. When comparing brokers, look at typical/average spreads rather than just minimums.

|

Feature |

CMC Markets CMC Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Minimum Deposit

info

|

$0

|

$20

|

|

Average spread (EUR/USD) - Standard account

info

|

1.3

info |

1.3

info |

|

All-in Cost EUR/USD - Active

info

|

0.65

info |

0.6

info |

|

Non-wire bank transfer

info

|

Yes

|

No

|

|

PayPal (Deposit/Withdraw)

info

|

Yes

|

No

|

|

Skrill (Deposit/Withdraw)

info

|

No

|

Yes

|

|

Bank Wire (Deposit/Withdraw)

info

|

Yes

|

Yes

|

Dive deeper: Best Low Spread Forex Brokers.

Join 239,000+ traders worldwide.

Regulated in 7 jurisdictions

Range of investments

CMC Markets vs HYCM: both brokers let you trade forex as CFDs or spot and both support U.S. and international exchange-traded shares (not just CFDs). Each also offers cryptocurrency CFDs, but neither lets you buy actual crypto. The big difference is market depth. CMC Markets lists 12,029 tradeable symbols and 141 forex pairs, while HYCM offers 1,199 symbols and 70 pairs. CMC Markets also includes copy trading; HYCM does not. For range of investments, CMC Markets earns 5 stars and ranks #9 out of 63 brokers on ForexBrokers.com, whereas HYCM earns 4 stars and ranks #27.

If you want more markets to choose from and the option to copy trade, CMC Markets is the stronger pick. HYCM still covers major asset classes and suits traders who need the essentials with crypto CFDs and access to both U.S. and international shares.

|

Feature |

CMC Markets CMC Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Forex Trading (Spot or CFDs)

info

|

Yes

|

Yes

|

|

Tradeable Symbols (Total)

info

|

12029

|

1199

|

|

Forex Pairs (Total)

info

|

141

|

70

|

|

U.S. Stocks (Shares)

info

|

Yes

|

Yes

|

|

Global Stocks (Non-U.S. Shares)

info

|

Yes

|

Yes

|

|

Copy Trading

info

|

Yes

|

No

|

|

Cryptocurrency (Underlying)

info

|

No

|

No

|

|

Cryptocurrency (CFDs)

info

|

Yes

|

Yes

|

|

Disclaimers

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Dive deeper: Best Copy Trading Platforms.

Trading platforms and tools

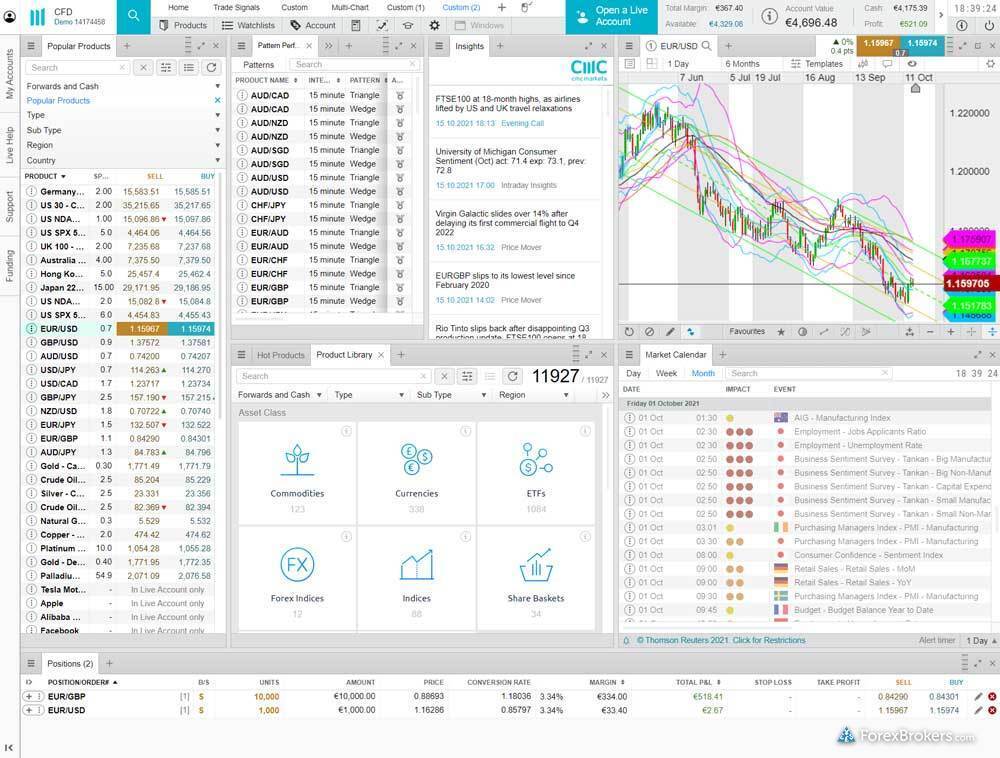

Comparing CMC Markets vs. HYCM for trading platforms and tools, both online brokers check key boxes: free demo (paper) trading, proprietary platforms, Windows desktop downloads, and web-based platforms. Each also supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5) and lets you place trades directly from charts. A clear difference is copy trading—CMC Markets offers it, while HYCM does not. Both brokers provide charting with technical indicators and watch lists, though specifics on counts aren’t disclosed here.

For platform quality, CMC Markets stands out with a 5-star rating and a #6 ranking out of 63 brokers for Trading Platforms and Tools (ForexBrokers.com). HYCM earns 4 stars and ranks #32. If you want copy trading and a higher-rated toolset, CMC Markets is the stronger pick. If you simply need MT4/MT5 plus an in-house platform and demo access, HYCM remains a viable choice.

|

Feature |

CMC Markets CMC Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Virtual Trading (Demo)

info

|

Yes

|

Yes

|

|

Proprietary Desktop Trading Platform

info

|

Yes

|

Yes

|

|

Desktop Platform (Windows)

info

|

Yes

|

Yes

|

|

Web Platform

info

|

Yes

|

Yes

|

|

Copy Trading

info

|

Yes

|

No

|

|

MetaTrader 4 (MT4)

info

|

Yes

|

Yes

|

|

MetaTrader 5 (MT5)

info

|

Yes

|

Yes

|

|

Charting - Indicators / Studies (Total)

info

|

73

|

30

|

|

Charting - Trade From Chart

info

|

Yes

|

Yes

|

Dive deeper: Best MetaTrader 4 Brokers, Best MetaTrader 5 Brokers.

Forex trading apps

CMC Markets and HYCM (Henyep Capital Markets) both offer mobile trading apps for iPhone and Android, complete with price alerts. The key difference is watchlists: CMC Markets syncs your symbols between the mobile app and your online account, while HYCM does not. Independent ratings underline the gap—CMC Markets earns 5 stars and ranks #5 out of 63 brokers for Mobile Trading Apps on ForexBrokers.com, whereas HYCM holds 4 stars and ranks #30.

On charting features, both apps let you draw trendlines and automatically save your drawings. HYCM offers 30 technical studies, edging out CMC Markets at 29, yet CMC’s higher overall rating and watchlist syncing may better suit traders who switch between phone and desktop. If you want a mobile trading app that works on iPhone and Android, sends price alerts, and includes strong charting tools, both brokers fit the bill; pick CMC Markets for smoother platform continuity, or HYCM if that extra indicator count matters most.

|

Feature |

CMC Markets CMC Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple iOS App

info

|

Yes

|

Yes

|

|

Mobile Price Alerts

info

|

Yes

|

Yes

|

|

Mobile Watchlists - Syncing

info

|

Yes

|

No

|

|

Mobile Charting - Indicators / Studies

info

|

29

|

30

|

|

Mobile Charting - Draw Trendlines

info

|

Yes

|

Yes

|

|

Mobile Charting - Trendlines Autosave

info

|

Yes

|

Yes

|

Dive deeper: Best Forex Trading Apps.

Market research

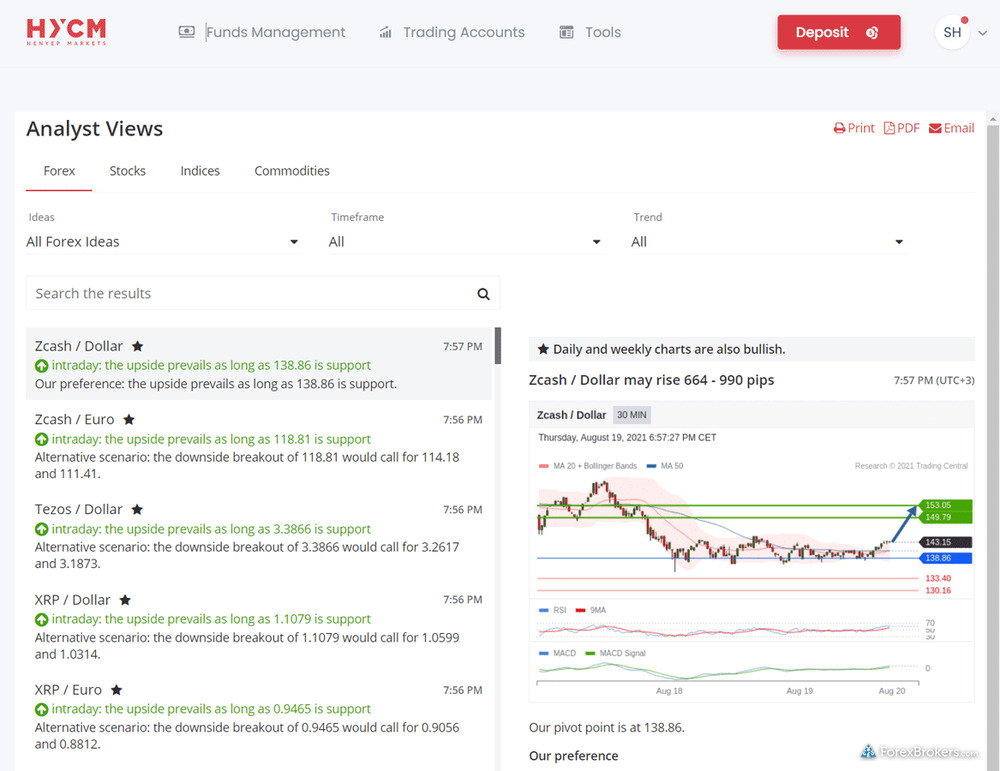

In the CMC Markets vs HYCM market research comparison, both brokers publish daily market commentary and stream forex news from top-tier sources such as Bloomberg, Reuters, and Dow Jones. Each platform also includes an economic calendar that tracks global events. Neither offers research from TipRanks or tools from Acuity Trading.

Key differences show up in analytics. CMC Markets includes Autochartist screening and a sentiment tool that displays long/short positioning across instruments, while HYCM provides Trading Central research but does not offer Autochartist or a sentiment gauge. These gaps align with independent scores: CMC Markets earns 5 stars for Research and ranks 6th out of 63 brokers at ForexBrokers.com, whereas HYCM receives 3.5 stars and ranks 29th.

|

Feature |

CMC Markets CMC Markets

|

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

|

Daily Market Commentary (Articles)

info

|

Yes

|

Yes

|

|

Forex News (Top-Tier Sources)

info

|

Yes

|

Yes

|

|

Autochartist

info

|

Yes

|

No

|

|

Trading Central

info

|

No

|

Yes

|

|

Client sentiment data

info

|

Yes

|

No

|

|

TipRanks

info

|

No

|

No

|

|

Acuity Trading

info

|

No

|

No

|

|

Economic Calendar

info

|

Yes

|

Yes

|

Dive deeper: Best Brokers for Forex Research.

Beginners and education

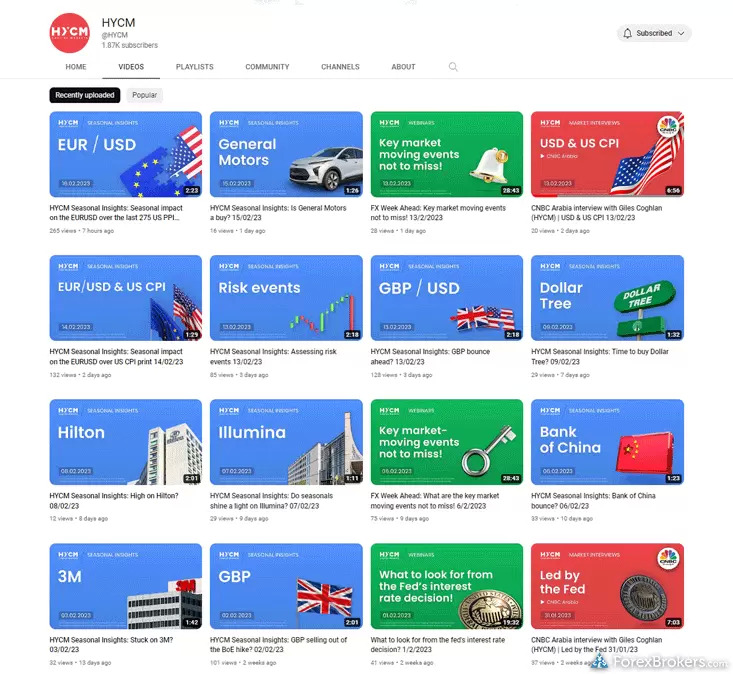

For beginners, both CMC Markets and HYCM provide an easy entry point with at least 10 beginner-focused videos that explain trading basics in clear, simple terms. Neither broker offers monthly educational webinars, so live, interactive learning options are limited.

CMC Markets pulls ahead as you progress: it also offers at least 10 advanced videos, while HYCM does not reach that level of depth. This difference shows in their Education scores—CMC Markets earns 5 stars and ranks #10 out of 63 brokers at ForexBrokers.com, whereas HYCM receives 3.5 stars and ranks #27. If you want a beginner-friendly starting point with room to grow, CMC Markets is the stronger choice; HYCM covers the essentials but has fewer advanced materials and no monthly webinars.

Dive deeper: Best Forex Brokers for Beginners.

Winner

After testing 63 of the best forex brokers, our research and account testing finds that CMC Markets is better than HYCM (Henyep Capital Markets). CMC Markets finished with an overall rank of #5, while HYCM (Henyep Capital Markets) finished with an overall rank of #26.

CMC Markets is well-trusted across the globe, and delivers a terrific trading experience thanks to its excellent pricing and selection of over 12,000 tradeable instruments.

FAQs

Can you trade cryptocurrency with CMC Markets or HYCM (Henyep Capital Markets)?

Neither CMC Markets nor HYCM (Henyep Capital Markets) allows you to buy actual delivered cryptocurrency, but both brokers offer cryptocurrency CFD trading instead.

What funding options does each broker offer?

Both CMC Markets and HYCM (Henyep Capital Markets) support bank wire transfers for deposits and withdrawals; CMC Markets additionally offers ACH or SEPA transfers and PayPal, while HYCM offers Skrill but not ACH or SEPA transfers or PayPal.

announcementPlease note:

We review each broker’s overall global offering – a “Yes” checkmark in our Compare Tool does not guarantee the availability of any specific features in your country of residence. To verify the availability of any features within your country of residence, please contact the broker directly.

navigate_before

navigate_next

|

Broker Screenshots

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Broker Gallery (click to expand) info

|

|

|

|

|

Regulation

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Trust Score info

|

99

|

86

|

|

|

Year Founded info

|

1989

|

1977

|

|

|

Publicly Traded (Listed) info

|

Yes

|

No

|

|

|

Bank info

|

No

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

Yes

info

|

No

info

|

|

|

Tier-1 Licenses info

|

6

|

2

|

|

|

Tier-2 Licenses info

|

1

|

1

|

|

|

Tier-3 Licenses info

|

0

|

0

|

|

|

Tier-4 Licenses info

|

0

|

1

|

|

|

Tier-1 Licenses (Highly Trusted)

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Australia (ASIC Authorised) info

|

Yes

|

No

|

|

|

Canada (CIRO Authorised) info

|

Yes

|

No

|

|

|

Hong Kong (SFC Authorised) info

|

No

|

Yes

|

|

|

Japan (FSA Authorised) info

|

No

|

No

|

|

|

Singapore (MAS Authorised) info

|

Yes

|

No

|

|

|

Switzerland (FINMA Authorised) info

|

|

|

|

|

United Kingdom (U.K.) (FCA Authorised) info

|

Yes

|

Yes

|

|

|

USA (CFTC Authorized) info

|

No

|

No

|

|

|

New Zealand (FMA Authorised) info

|

Yes

|

No

|

|

|

Regulated in one or more EU or EEA countries (MiFID). info

|

Yes

info

|

No

info

|

|

|

Tier-2 Licenses (Trusted)

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Kenya (CMA Authorised) info

|

|

|

|

|

Israel (ISA Authorised) info

|

No

|

No

|

|

|

South Africa (FSCA Authorised) info

|

No

|

No

|

|

|

UAE (DFSA, FSRA, or SCA Authorised) info

|

Yes

|

Yes

|

|

|

India (SEBI Authorised) info

|

No

|

No

|

|

|

Jordan (JSC Authorised) info

|

|

|

|

|

Investments

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Forex Trading (Spot or CFDs) info

|

Yes

|

Yes

|

|

|

Tradeable Symbols (Total) info

|

12029

|

1199

|

|

|

Forex Pairs (Total) info

|

141

|

70

|

|

|

U.S. Stocks (Shares) info

|

Yes

|

Yes

|

|

|

Global Stocks (Non-U.S. Shares) info

|

Yes

|

Yes

|

|

|

Copy Trading info

|

Yes

|

No

|

|

|

Cryptocurrency (Underlying) info

|

No

|

No

|

|

|

Cryptocurrency (CFDs) info

|

Yes

|

Yes

|

|

|

Disclaimers |

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients).

|

|

|

Cost

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Average spread (EUR/USD) - Standard account info

|

1.3

info

|

1.3

info

|

|

|

All-in Cost EUR/USD - Active info

|

0.65

info

|

0.6

info

|

|

|

Inactivity Fee info

|

Yes

|

No

|

|

|

Order execution: Agency info

|

No

|

Yes

|

|

|

Order execution: Market Maker info

|

Yes

|

Yes

|

|

|

Funding

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Minimum Deposit info

|

$0

|

$20

|

|

|

PayPal (Deposit/Withdraw) info

|

Yes

|

No

|

|

|

Skrill (Deposit/Withdraw) info

|

No

|

Yes

|

|

|

Bank Wire (Deposit/Withdraw) info

|

Yes

|

Yes

|

|

|

Non-wire bank transfer info

|

Yes

|

No

|

|

|

Trading Platforms

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Proprietary Desktop Trading Platform info

|

Yes

|

Yes

|

|

|

Desktop Platform (Windows) info

|

Yes

|

Yes

|

|

|

Web Platform info

|

Yes

|

Yes

|

|

|

Copy Trading info

|

Yes

|

No

|

|

|

MetaTrader 4 (MT4) info

|

Yes

|

Yes

|

|

|

MetaTrader 5 (MT5) info

|

Yes

|

Yes

|

|

|

cTrader info

|

No

|

No

|

|

|

Trading Tools

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Virtual Trading (Demo) info

|

Yes

|

Yes

|

|

|

Price Alerts info

|

Yes

|

Yes

|

|

|

Charting - Indicators / Studies (Total) info

|

73

|

30

|

|

|

Charting - Trade From Chart info

|

Yes

|

Yes

|

|

|

Charts can be saved info

|

Yes

|

Yes

|

|

|

Mobile Trading

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple iOS App info

|

Yes

|

Yes

|

|

|

Mobile Price Alerts info

|

Yes

|

Yes

|

|

|

Mobile Watchlist [DELETED] info

|

|

|

|

|

Mobile Watchlists - Syncing info

|

Yes

|

No

|

|

|

Mobile Charting - Indicators / Studies info

|

29

|

30

|

|

|

Mobile Charting - Draw Trendlines info

|

Yes

|

Yes

|

|

|

Mobile Charting - Trendlines Autosave info

|

Yes

|

Yes

|

|

|

Mobile Research - Economic Calendar info

|

Yes

|

Yes

|

|

|

Research

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Daily Market Commentary (Articles) info

|

Yes

|

Yes

|

|

|

Forex News (Top-Tier Sources) info

|

Yes

|

Yes

|

|

|

Autochartist info

|

Yes

|

No

|

|

|

Trading Central info

|

No

|

Yes

|

|

|

TipRanks info

|

No

|

No

|

|

|

Client sentiment data info

|

Yes

|

No

|

|

|

Economic Calendar info

|

Yes

|

Yes

|

|

|

Education

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

Webinars info

|

No

|

No

|

|

|

Videos - Beginner Trading Videos info

|

Yes

|

Yes

|

|

|

Videos - Advanced Trading Videos info

|

Yes

|

No

|

|

|

Major Forex Pairs

|

CMC Markets |

HYCM (Henyep Capital Markets) |

|

|

GBP/USD [DELETED] info

|

|

|

|

|

USD/JPY [DELETED] info

|

|

|

|

|

EUR/USD info

|

Yes

|

Yes

|

|

|

USD/CHF [DELETED] info

|

|

|

|

|

USD/CAD [DELETED] info

|

|

|

|

|

NZD/USD [DELETED] info

|

|

|

|

|

AUD/USD [DELETED] info

|

|

|

|

|

Review |

CMC Markets Review

|

HYCM (Henyep Capital Markets) Review

|

|

arrow_upward